Since many business owners devoted to the cloud are concerned about developer productivity more than cloud costs, sooner or later they experience budget overrun.

Exactly at that moment, they start realizing that implementing cloud cost management tools is the question of the first priority. As they dig deeper into the strategies and practices that would help them to optimize cloud costs, they face the term “FinOps”.

In this article, we will give a definition to the term, outline key problems that it solves, and talk about what companies need to consider while adopting FinOps.

Let’s start with the definition.

What is FinOps?

FinOps stands for Cloud Financial Operations or Cloud Financial Management. It presents a set of particular standards and best practices for organizing collaboration of people, processes, and technology in a way a company gets the most value out of every cent spent in the cloud.

In terms of cultural perception of the term, FinOps is a mechanism that makes teams and departments take ownership of their cloud usage by means of providing better visibility into cloud cost allocation.

What problems can FinOps solve?

Since we have already mentioned cost allocation, let’s continue with that. The first and the most frequently appeared problem among cloud consumers is related to the fact that numerous cloud resources are not assigned or incorrectly assigned to the assets they belong to.

As a consequence, it creates difficulties for those who are responsible for forming financial statements and reports. Cost misallocation brings chaos in associating cloud cost bills with cost-generating objects.

While FinOps is used in the company it simplifies the process of calculating the true efficiency of the department or team and identifying the accountability for each cost item in the bill received.

Another problem lies in unexpected cloud sprawl. Cloud sprawl is the term used for describing the uncontrolled proliferation of cloud providers and Saas instances.

As an example, imagine that a company uses storage of different providers that are not fully interoperable or purchases more application licenses than needed. When referred to providers it causes data consistency challenges, when to SaaS applications – it brings unnecessary waste.

That is the reason why it’s vital to have the whole picture of what’s going on in the cloud environment of the company. FinOps works on reaching greater transparency of cloud assets to reduce bills and improve overall performance.

What do companies need to consider?

FinOps strategies should be implemented gradually. In order to make the process go smoothly, it’s better to prepare the ground in advance. There are 4 basic steps that companies are recommended to take to enjoy the benefits of cloud financial management:

- Provide total visibility – which implies constant monitoring of resource utilization rates across multiple clouds.

- Focus on optimization – which means getting rid of excessive costs in the cloud resulting from overprovisioning or resources underutilization.

- Master data-driven management is all about taking control of resource usage and provisioning to avoid unnecessary costs.

- Establish an automation workflow that would facilitate various processes in the cloud or as an option inform users of overspending or possible policy violations.

If a company follows these steps, not only it optimizes its cloud costs but also improves employees’ productivity. Ensuring transparency of the costs generating processes in the cloud may help business owners make more reasonable decisions faster.

It will free up precious time for defining the company’s development vector instead of being trapped in a vicious circle of solving endless operational issues. In a nutshell, FinOps serves as a tool that helps companies stay at the top of their performance.

Who is responsible for FinOps?

Once a company identifies the problems, considers best practices to solve them, defines the strategy and steps required for adopting FinOps, the following question arises – who will be in charge of FinOps development? Somebody from the team or an invited specialist? What exactly will this person be responsible for?

Based on the workload and the level of expertise it’s recommended to have a person whose main duty will be to implement and keep FinOps going – no matter will that be somebody from the team or an invited expert. His or her main responsibility will be pushing FinOps processes.

Many business owners hire a Cloud Economist who is expected to be involved in:

- Providing communication with cloud vendors to understand offers better and get assurances, for example, on security matters.

- Making employees think about costs for the resources they utilize at the workplace with the help of showback or chargeback policies implementation.

- Ensuring organization’s accountability around cloud cost by implementing KPI.

Another thing that should be kept in mind – the Cloud Economist works in collaboration with other company’s units – not in a vacuum. He or she must be constantly in touch with the company’s Executives, DevOps Team, and Finance & Procurement department.

Together they should work on providing the effectiveness of implemented policies that impact the cloud financials, operations, security, and compliance.

How to reach financial accountability in the cloud?

We have already discovered what companies need to consider while adopting FinOps and who is generally responsible for getting related processes done. Now let’s shift to the tools that would help companies to build strong relations across cloud teams in order to provide financial accountability.

Showback and chargeback

Many companies show team members how much money they spend and which resources they’re using. This approach is referred to as showback. It is usually performed by sending an invoice to departments in order to show their spending over a defined period.

After fully implementing showback, the company can consider adopting a chargeback approach. It involves not only the demonstration of the number of resources each department utilizes but also charging teams for them. Making employees responsible for the finances they use changes their behavior and optimizes cloud costs.

Tagging

This tool is an essential part of showback and chargeback implementation. A properly integrated tagging policy is one of the most effective cloud cost optimization practices. So, the relevant question is how to use tagging in the most productive way?

Tagging works if only all the assets across cloud architecture are tagged with the same keys and values, in the same format. Tags are sensitive to capitalization and misspellings, so the company should pay close attention to these factors. Otherwise, cloud cost analysis and allocation will be incorrect and misleading.

The main problem with tagging strategy lies in the differences between tag names of several cloud providers. For example, when using AWS you can tag EC2 instances with any character, but you’re not allowed to do that for the other resources.

To sum up

FinOps is an essential part of a viable cost optimization strategy. It includes a very useful set of principles, practices, and tools which help companies get a better understanding of bills they receive and allocate their resources correspondingly to the consumption rate or a workload.

Some practices may be difficult to implement especially on the basis of multi-cloud architecture. In this case, to get the most out of the FinOps, it’s recommended to use third-party applications like Binadox.

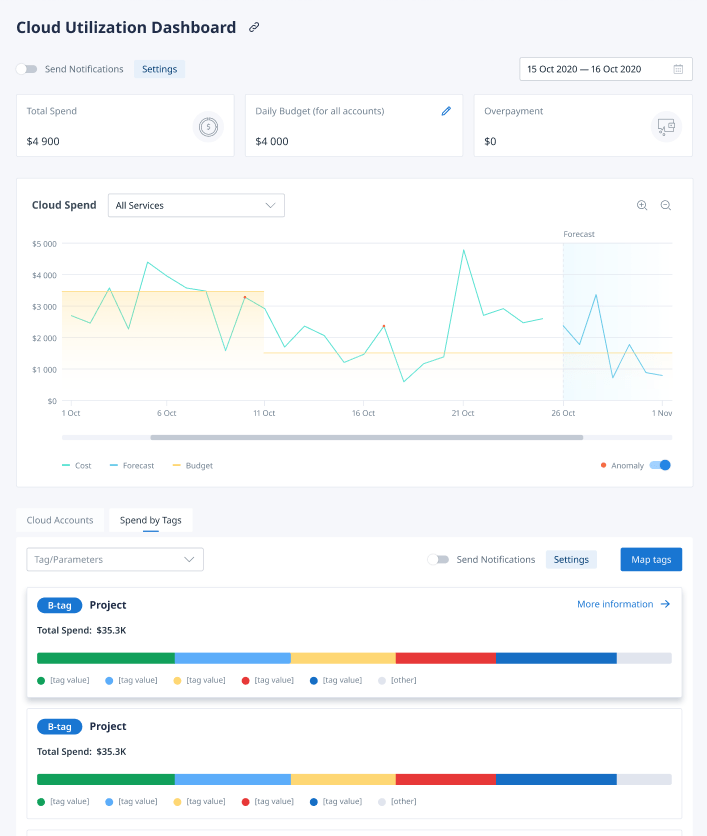

It provides visibility and simplifies the monitoring process. Moreover, the platform allows users to tag resources no matter what cloud vendor provides them. Binadox platform allows its users to detect cost anomalies and monitor services utilization in detail.

Sign up for a free 14-day trial.