Key Financial Metrics for SaaS: Defining Success in the Subscription Revenue Model

In today’s digital landscape, SaaS solutions have revolutionized how businesses deliver and consume software. This shift has brought about new challenges in measuring success and financial performance. Understanding key financial metric definitions is crucial for SaaS companies to thrive in the competitive market.

The Importance of Financial Metrics in SaaS

The SaaS revenue model, based on subscriptions, has transformed traditional software sales, necessitating a new approach to financial analysis and performance measurement. Unlike one-time purchase models, SaaS solutions rely on recurring revenue streams, making it essential to track customer acquisition, retention, and lifetime value. Financial metric definitions specific to SaaS solutions help companies track progress, identify areas for improvement, and make data-driven decisions that drive growth and profitability in the SaaS revenue model.

These metrics provide insights into various aspects of a SaaS business, from customer behavior and revenue patterns to operational efficiency and overall financial health. By closely monitoring metrics, SaaS companies can optimize their strategies, allocate resources more effectively, and demonstrate value to investors and stakeholders. Moreover, these financial metric definitions enable businesses to benchmark their performance against industry standards and competitors, helping them stay competitive in the rapidly evolving SaaS landscape.

Core SaaS Financial Metrics

Understanding these fundamental metrics is crucial for any SaaS business looking to measure its financial health and growth potential within the SaaS revenue model.

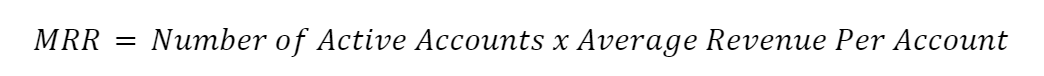

1. Monthly Recurring Revenue (MRR)

MRR is a fundamental financial metric definition for SaaS companies. It represents the predictable monthly revenue generated from subscriptions in the SaaS revenue model.

Example: If a company has 100 customers paying $50 per month, the MRR would be $5,000.

MRR is the lifeblood of SaaS businesses. It provides a clear picture of the company’s current financial state and helps in forecasting future revenue. By tracking MRR, businesses can:

- Predict cash flow more accurately

- Measure the impact of pricing changes

- Assess the effectiveness of upselling and cross-selling strategies

- Identify trends in customer behavior

It’s important to note that MRR should only include recurring revenue, not one-time fees or variable usage charges within the SaaS revenue model

Note:

Want to see these financial metrics in action? Explore our article Top SaaS Companies: Examples of Successful Software as a Service to learn how industry leaders apply these principles to achieve remarkable growth and profitability in the competitive SaaS landscape.

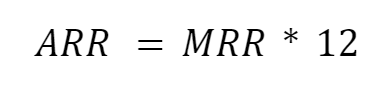

2. Annual Recurring Revenue (ARR)

ARR provides a yearly perspective on recurring revenue, crucial for long-term planning in the SaaS revenue model.

Example: An MRR of $5,000 translates to an ARR of $60,000.

While MRR focuses on short-term performance, ARR gives a broader view of a SaaS company’s financial health. ARR is particularly useful for:

- Long-term financial planning and budgeting

- Attracting investors, as it demonstrates the company’s ability to generate consistent revenue

- Comparing performance year-over-year

- Setting annual growth targets

ARR is typically used by companies with longer contract terms (usually annual or multi-year). For businesses with shorter subscription periods, MRR might be more relevant in the SaaS revenue model.

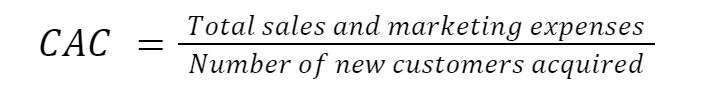

3. Customer Acquisition Cost (CAC)

CAC measures the cost of acquiring a new customer, essential for assessing marketing and sales efficiency in SaaS solutions.

Example: If a company spends $10,000 on marketing and acquires 100 new customers, the CAC is $100.

CAC is a critical financial metric definition for evaluating the efficiency of a SaaS company’s growth strategy. It helps businesses:

- Determine the viability of their customer acquisition methods

- Optimize marketing and sales spending

- Assess the potential profitability of different customer segments

- Make informed decisions about scaling operations

A rising CAC might indicate market saturation or inefficient marketing strategies, while a decreasing CAC could suggest improved targeting or brand recognition within the SaaS landscape.

Note:

As your SaaS business grows, managing access becomes crucial. Dive into our article The Rise of SaaS Applications: Effective Access Control to learn how proper access management can enhance security and operational efficiency, complementing your financial success.

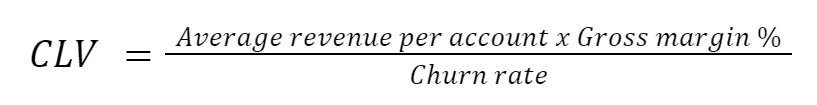

4. Customer Lifetime Value (CLV)

CLV is another crucial financial metric definition for understanding the long-term value of customer relationships in SaaS solutions.

Example: If the average revenue per account is $1,000, gross margin is 80%, and churn rate is 5%, the CLV would be $16,000.

CLV is a crucial financial metric definition for understanding the long-term value of customer relationships in SaaS solutions. It helps SaaS companies:

- Determine how much they can afford to spend on customer acquisition

- Identify the most valuable customer segments

- Make informed decisions about customer retention strategies

- Forecast long-term revenue potential

A high CLV relative to CAC indicates a healthy, sustainable SaaS revenue model. Ideally, companies should aim for a CLV that is at least three times higher than their CAC.

These core financial metric definitions provide a comprehensive view of a SaaS company’s financial health, growth potential, and operational efficiency. By regularly tracking and analyzing these metrics, businesses can make data-driven decisions to optimize their performance in the competitive SaaS market.

Growth and Retention Metrics

Growth and retention metrics are vital for SaaS solutions to gauge their success in acquiring and retaining customers. These financial metric definitions offer crucial insights into the sustainability and scalability of the SaaS business model.

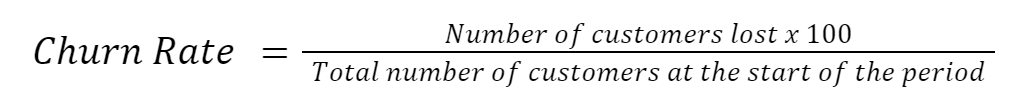

1. Churn Rate

Churn rate measures the percentage of customers who cancel or don’t renew their subscriptions within a given period in the SaaS revenue model.

Example: If a company starts with 1,000 customers and loses 50 in a month, the monthly churn rate is 5%.

A high churn rate can signal product dissatisfaction, poor customer service, or strong competition in the SaaS market. Reducing churn is often more cost-effective than acquiring new customers. Strategies include improving onboarding, enhancing support, and implementing proactive customer success programs for SaaS solutions.

Note:

Looking to optimize your SaaS expenses? Our article SaaS Spend Management: Maximizing Efficiency in Software Subscriptions offers valuable insights on controlling costs and improving ROI. Learn how effective spend management can positively impact your key financial metrics.

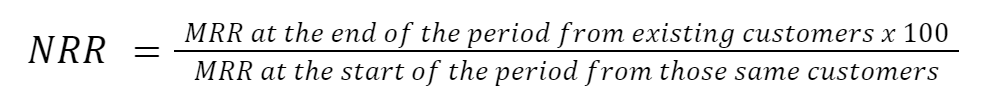

2. Net Revenue Retention (NRR)

NRR is a crucial financial metric definition that indicates how well a SaaS company retains and grows revenue from existing customers.

Example: If MRR at the start is $100,000, and at the end of the period, the same cohort generates $105,000, NRR would be 105%.

NRR captures customer retention, upsells, expansions, downgrades, and contractions in the SaaS revenue model. An NRR exceeding 100% indicates revenue growth from existing customers, even accounting for churn. Many SaaS solutions aim for an NRR of 110% or higher.

3. Expansion Revenue

Expansion revenue represents additional revenue generated from existing customers through upsells or cross-sells in SaaS solutions.

Example: If existing customers initially paid $10,000 and now pay $12,000 due to upgrades, expansion revenue is $2,000.

Focusing on expansion revenue often yields lower acquisition costs and higher conversion rates in the SaaS revenue model. Strategies include tiered pricing, complementary products, and effective account management.

These financial metric definitions provide valuable insights into customer base health and growth potential. Regular monitoring enables data-driven decision-making and operational optimization in SaaS companies.

Profitability Metrics

Profitability metrics are crucial financial metric definitions for assessing the financial health and sustainability of SaaS businesses. These metrics help companies understand how efficiently they’re generating profit from their revenue and investments in the SaaS revenue model.

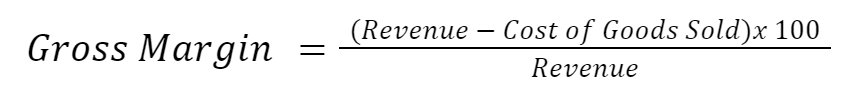

1. Gross Margin

Gross margin measures the percentage of revenue retained after accounting for the direct costs of providing the SaaS solutions.

Example: If revenue is $100,000 and COGS is $30,000, the gross margin is 70%.

Note:

Want to understand how your SaaS architecture impacts financial performance? Check out our article Understanding SaaS Architecture: Key Concepts and Best Practices to learn how a well-designed architecture can enhance scalability and efficiency, directly influencing your financial metrics.

Gross margin is a key indicator of a SaaS company’s efficiency in delivering its product. A high gross margin is typical in the SaaS industry due to the low marginal cost of serving additional customers. However, it’s important to note that gross margin can vary depending on the specific SaaS revenue model and scale of operations.

SaaS companies offering high-touch services or those in early stages might have lower gross margins. As businesses scale, they often see improvements in gross margin due to economies of scale. Monitoring trends in gross margin can provide insights into a company’s pricing power, operational efficiency, and overall competitiveness in the SaaS market.

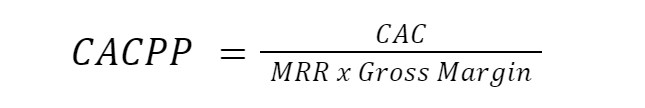

2. Customer Acquisition Cost Payback Period

This financial metric definition shows how long it takes to recover the cost of acquiring a new customer in the SaaS revenue model.

Example: If CAC is $1,000, MRR is $100, and gross margin is 70%, the payback period is 14.3 months.

The CAC payback period is critical for assessing the efficiency of a SaaS company’s growth strategy. A shorter payback period indicates a more capital-efficient business model. This metric is particularly important for SaaS solutions relying on outside funding, as investors often look for payback periods of 12 months or less.

Factors influencing the CAC payback period include pricing strategy, customer retention rates, and upselling effectiveness. SaaS companies can improve this metric by optimizing marketing and sales processes, increasing customer lifetime value, or reducing acquisition costs without sacrificing growth.

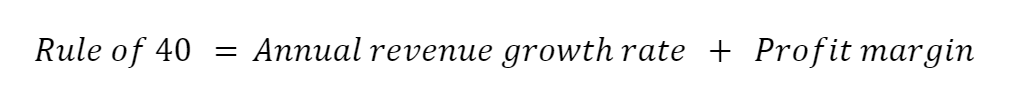

3. Rule of 40

The Rule of 40 is a principle stating that a SaaS company’s combined growth rate and profit margin should exceed 40% in the SaaS revenue model.

Example: If a company has a 30% growth rate and a 15% profit margin, its Rule of 40 score is 45%.

Note:

Curious about the Rule of 40 and its impact on SaaS valuations? Check out our in-depth article What You Need to Know About the Rule of 40 in SaaS for a deeper dive into this crucial financial metric and how it can guide your strategic decisions.

The Rule of 40 has gained popularity as a quick way to assess the overall health and balance of SaaS solutions. It recognizes that companies often need to make trade-offs between growth and profitability, especially in their early stages. A score above 40% is generally considered good, indicating effective balance between growth and profitability in the SaaS revenue model.

The interpretation of this financial metric definition can vary depending on the company’s stage and market conditions. While the Rule of 40 is a useful benchmark, it shouldn’t be used in isolation. SaaS companies should consider it alongside other metrics and their specific strategic goals when making decisions.

Cash Flow Metrics

Cash flow metrics are crucial financial metric definitions for SaaS companies to understand their liquidity and ability to fund operations and growth. These metrics help businesses ensure they have enough cash to meet their obligations and invest in future growth opportunities within the SaaS revenue model.

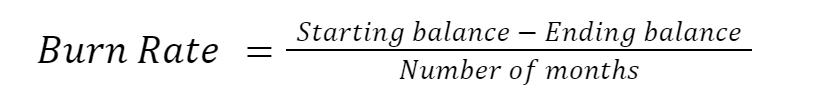

1. Burn Rate

Burn rate is a key financial metric definition that measures how quickly a SaaS company is spending its cash reserves.

Example: If a company starts with $1,000,000 and ends with $700,000 after 6 months, the monthly burn rate is $50,000.

Understanding burn rate is crucial for startups and growth-stage SaaS solutions that may not yet be profitable. It helps determine how long a company can operate before needing additional funding. A high burn rate might indicate aggressive growth strategies or operational inefficiencies in the SaaS revenue model. Companies should regularly analyze their burn rate in conjunction with their growth metrics to ensure they’re achieving a good return on their spending.

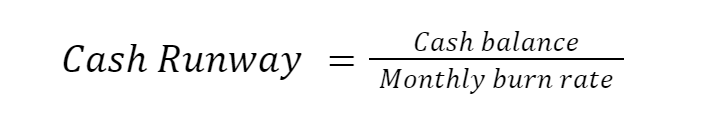

2. Cash Runway

Cash runway is another important financial metric definition that indicates how long a SaaS company can continue operating before running out of cash.

Example: With a cash balance of $500,000 and a monthly burn rate of $50,000, the cash runway is 10 months.

Cash runway is a critical metric for SaaS solutions, especially those not yet profitable or those in high-growth phases. It provides insight into how much time the company has to achieve key milestones or secure additional funding within the SaaS revenue model.

A longer runway gives SaaS companies more flexibility and time to execute their strategies. However, it’s important to note that the cash runway can change quickly if the burn rate increases or if unexpected expenses arise in the SaaS business model.

Note:

Wondering how to effectively manage your growing SaaS portfolio? Our article Navigating the SaaS Era: The Role of Software Asset Management Services in Modern IT explores how SAM can help optimize your SaaS investments and improve financial performance. Discover strategies to align your IT assets with your business goals.

Operational Efficiency Metrics for SaaS Solutions

Operational efficiency metrics help SaaS companies understand how well they’re utilizing their resources to generate revenue and deliver value to customers. These financial metric definitions are crucial for identifying areas of improvement and scaling the business effectively within the SaaS revenue model.

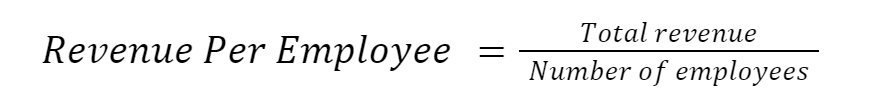

1. Revenue Per Employee

This financial metric definition measures how efficiently a SaaS company generates revenue relative to its workforce size.

Example: If annual revenue is $5,000,000 and the company has 50 employees, revenue per employee is $100,000.

Revenue per employee is a key indicator of a SaaS company’s operational efficiency and productivity. A higher value generally indicates that the company is generating more revenue with fewer resources, which can translate to higher profitability in the SaaS revenue model.

However, it’s important to compare this metric within the same industry and among companies of similar size and stage, as it can vary significantly across different SaaS solutions and growth stages. Over time, SaaS companies should aim to increase this metric as they scale, leveraging technology and processes to drive higher revenue without proportional increases in headcount.

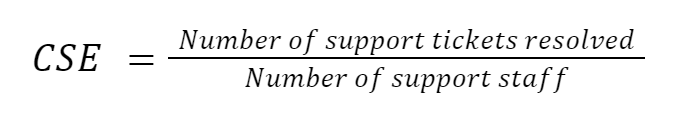

2. Customer Support Efficiency

This financial metric definition assesses the efficiency of customer support operations in SaaS solutions.

Example: If 1,000 tickets are resolved by 10 support staff in a month, the efficiency is 100 tickets per staff member.

Customer support efficiency is crucial for maintaining customer satisfaction while managing costs in the SaaS revenue model. A higher number of resolved tickets per staff member generally indicates more efficient support operations.

However, it’s important to balance this metric with quality measures, such as customer satisfaction scores or resolution time, to ensure that efficiency isn’t coming at the expense of service quality. SaaS companies can improve this metric by implementing self-service options, using AI-powered chatbots, or improving their knowledge base to reduce the number of support tickets.

Note:

Interested in expanding your metrics knowledge beyond SaaS? Our article Metrics of Measurement: Essential Analytics for Cloud Computing explores key performance indicators for cloud-based services. Discover how these analytics complement SaaS metrics to provide a comprehensive view of your technology investments.

SaaS Valuation Metrics

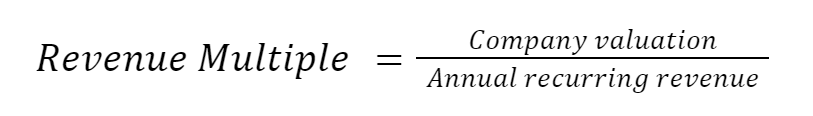

1. Revenue Multiple

Revenue multiple is a common valuation metric for SaaS solutions, especially those not yet profitable.

Example: If a company is valued at $100 million with $20 million ARR, its revenue multiple is 5x.

The revenue multiple is widely used in the SaaS industry due to its simplicity and applicability to companies at various growth stages within the SaaS revenue model. Higher multiples are often associated with SaaS companies showing rapid growth, high gross margins, or strong market positioning.

However, it’s important to note that revenue multiples can vary significantly based on market conditions, company size, and growth rate. Investors and analysts often compare a company’s revenue multiple to those of similar SaaS solutions in the industry to assess relative valuation.

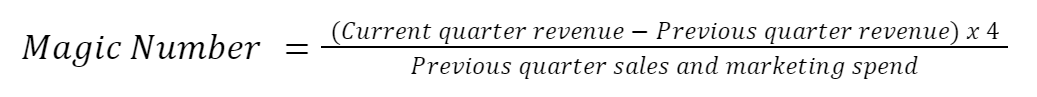

2. Magic Number

The magic number is a financial metric definition that measures the efficiency of a SaaS company’s sales and marketing efforts.

Example: If Q2 revenue is $1.2 million, Q1 revenue was $1 million, and Q1 sales and marketing spend was $300,000, the magic number is 2.67.

The magic number provides insights into how effectively a company is converting sales and marketing spend into revenue growth within the SaaS revenue model. A magic number above 1 is generally considered good, indicating that the SaaS company is generating more incremental revenue than it’s spending on sales and marketing.

However, this metric should be evaluated over time, as it can fluctuate from quarter to quarter. SaaS solutions with higher magic numbers are often viewed more favorably by investors, as it suggests a more efficient and scalable growth model.

Conclusion: Leveraging Financial Metrics for SaaS Success

Understanding and tracking these key financial metric definitions is crucial for SaaS solutions to navigate the complex SaaS revenue model. By focusing on these metrics, businesses can optimize their operations, improve customer retention, and drive sustainable growth in the SaaS market.

Remember, while these metrics provide valuable insights, they should be considered holistically. The specific importance of each financial metric definition may vary depending on a SaaS company’s stage, target market, and business model.

To learn more about SaaS management and dive deeper into these financial metric definitions, visit our Binadox blog. We regularly publish insights and practical advice to help you navigate the complex world of SaaS solutions and optimize your business performance within the SaaS revenue model.

Wondering how SaaS agreements impact your financial metrics? Our article Navigating SaaS Agreements: Essential Considerations for Effective SaaS Management delves into the critical aspects of SaaS contracts. Learn how well-negotiated agreements can positively influence your bottom line and overall SaaS management strategy.